A Solid Year for Fasteners

Most publicly-traded companies with fastener businesses achieved sales and profit growth in 2016, driven by strength in aerospace and automotive markets.

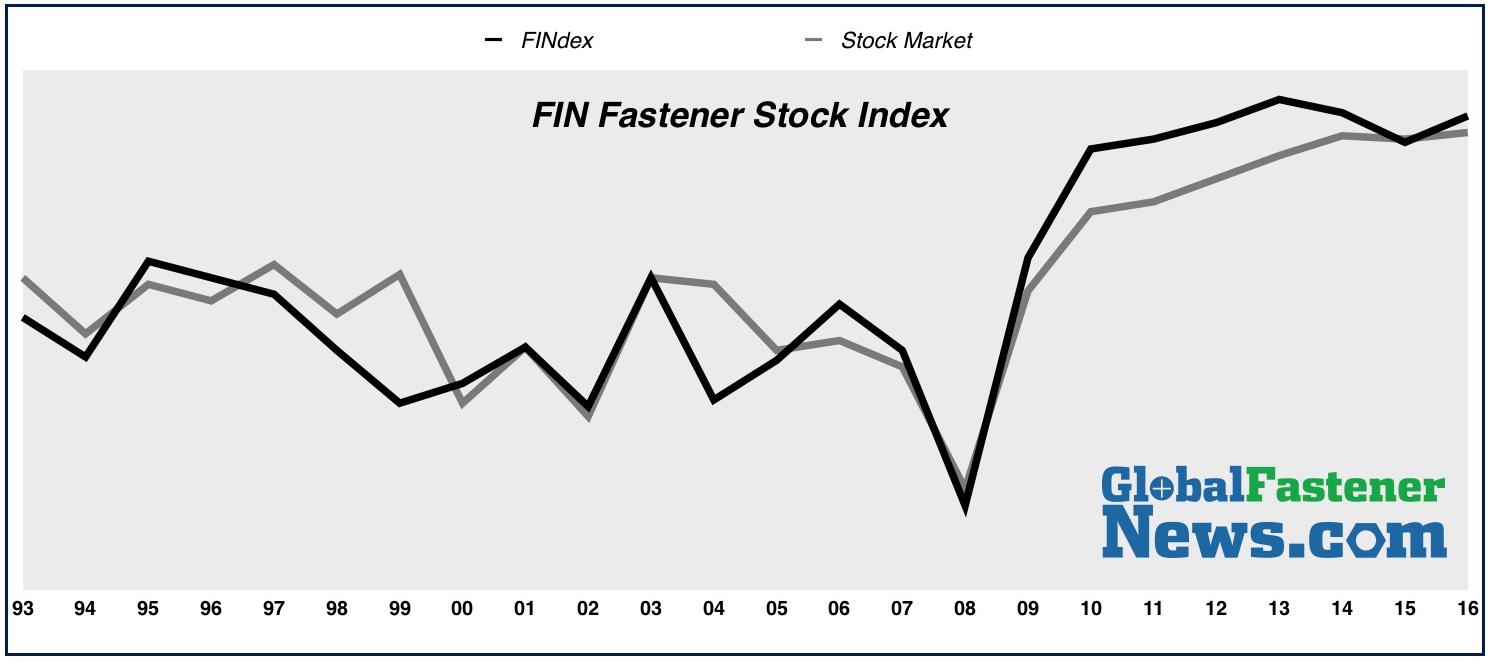

The FIN Fastener Stock Index also achieved growth, as certain investors saw value in industrial companies. The FINdex rose 20%, compared to an 11.1% gain by an index of related industrial stocks in 2016.

Arconic reported full-year EPS segment revenue rose 7% to $5.7 billion, with ATOI up 8% to $642 million. Adjusted EBITDA gained 8% to $1.2 billion and adjusted EBITDA margin was 20.9%.

Overall results for Arconic, which includes Alcoa’s former $1.8 billion Fastening Systems and Rings business, included a net loss of $900 million on income of $12.4 billion in 2016, hampered by metal pricing, foreign currency exchange rate fluctuations, and price and product mix.

In 2017, Bossard Americas opened its Silicon Valley-based Bossard Design Center (BDC), a 10,000 sq ft fastener design and testing facility located 20 miles east of the largest U.S. electric vehicle manufacturer, Tesla.

During 2016, Bossard Group sales grew 5.9% to a record CHF 695 million (US$686.8 million), boosted by strong growth in Europe and North America.

Carpenter Technology revenue for fiscal 2016 declined 18.5% to $1.81 billion. Operating income dropped 53% to $51.6 million, while net income declined 80% to $11.3 million.

“All Aerospace sub-markets generated growth, except fasteners, which continues to be impacted by inventory channel adjustments,” the company stated.

Chicago Rivet & Machine Co. reported “financial results for 2016 were very positive, with both operating segments recording increases in sales while net income improved by an impressive 39.7%.”

Fastener segment sales grew 0.16% to $33.1 million, supported by modest growth in domestic automobile and light truck sales.

“In addition to the increase in sales during 2016, our margins benefited from lower raw material prices compared to the year earlier period.”

Dorman Products reported sales, including fasteners, increased 7% to $860 million in 2016. Gross profit rose 10% to $338.1 million, with gross margin edging up to 39.3%. EPS rose 18% to $3.07.

“We are pleased to announce another successful year highlighted by record sales and earnings,” stated CEO Matt Barton.

Bisco Industries reported revenues, including fasteners, rose 6% to $148.5 million in fiscal 2016. Gross profit grew 6% to $43.6 million, with gross margin flat at 29.3%. Full-year net income increased 9.5% to $4.1 million.

Bisco Industries opened three new sales facilities in fiscal 2016.

Fastenal Co. reported fastener sales, which represented 35.6% of net sales in the first quarter of 2017, grew 0.8% to $373.8 million during the period. Quarterly results were improved by a 1.5% gain in fastener sales in February, marking the company’s first uptick in fastener sales since the third quarter of 2015.

“Our fastener sales, which are really indicators of the economy in all honesty, have struggled ever since the second quarter of 2015,” stated CEO Dan Florness. “And that business grew, returned to growth in the first quarter.”

Grainger sales increased 1.6% to $10.14 billion, while operating earnings declined 14% to $1.1 billion and net earnings 19% to $632.8 million. Capital expenditures dropped 24% to $284.2 million.

Sales in the U.S. declined 1.2% to $7.9 billion in 2016, while sales in Canada dropped 17% to $733.8 million and sales in Europe, Asia and Latin America grew 34% to $1.9 billion.

ITW reported Automotive OEM segment sales, including fasteners, increased 26% to $773 million in the fourth quarter of 2016, boosted by the $450 million acquisition of the global automotive Engineered Fasteners and Components business of ZF TRW. Segment profit increased 32% to $178 million, while the Q4 operating margin improved to 23%.

KLX – the former Consumables Management segment of B/E Aerospace – reported Aerospace Solutions Group (ASG) business revenue, primarily from fasteners, increased 4.9% to $1.4 billion in fiscal 2016, which ended January 31.

ASG gains were driven by the contribution of Herndon’s military aftermarket business and increased aircraft maintenance activity.

Lawson Products reported sales, including fasteners, increased 0.25% to $276.6 million in 2016. Gross profit declined 0.6% to $168.1 million.

“Our business improved as 2016 came to a close,” stated CEO Michael DeCata. “It appears the economic headwinds we have faced have begun to subside.”

Average daily sales increased 5.4% to $1.122 million in Q4. Total Q4 sales rose 3.6% to $67.3 million.

MSC Industrial reported sales increased 2.9% to $703.8 million in the second quarter of fiscal 2017, which ended ended March 4, 2017.

Gross margin was 44.7%, a 40 basis point decline year-over-year. Operating income gained 7.6% to $86.6 million, with an operating margin of 12.3%, a 50 basis point increase. Net income grew 8.1% to $53.6 million.

Nucor reported Cold Finished Steel segment sales, including results from Nucor Fastener, rose 3% to 122,000 tons in the opening quarter of 2017.

Consolidated net sales increased 22% to $4.82 billion in Q1 from $3.96 billion in the fourth quarter of 2016 and increased 30% compared with $3.72 billion in the first quarter of 2016.

Park-Ohio reported Supply Technologies revenue, including fasteners, dropped 13.2% to $502.1 million in 2016. Segment operating income fell 20% to $40 million for the year.

“Most economic indicators suggest modest organic growth in the industrial sector for 2017,” stated CEO Edward Crawford.

Simpson Manufacturing reported sales, including fasteners, rose 8% to $861 million in 2016, while net income rose 32% to $90 million. Gross profit grew 15% to $412 million, with a margin of 48%.

Sales in North America grew 10% to $742 million in 2016, while sales in Europe gained 3% to $111.3 million.

Stanley Black & Decker reported Engineered Fastening organic revenues increased 4%, as strong automotive volumes more than offset weaker industrial and electronics volumes.

“We were particularly pleased to see Engineered Fastening exceed its growth projections based on better than expected automotive performance,” stated CEO James Loree.

TriMas Corp. reported sales for its Aerospace segment, which is comprised of the Monogram Aerospace Fasteners, Allfast Fastening Systems, Mac Fasteners and Martinic Engineering brands, increased 1.8% to $42.9 million in the fourth quarter of 2015, boosted by incremental sales related to the November 2015 acquisition of a machined components facility in Arizona.

Full-year Aerospace segment sales fell 0.8% to $174.9 million, with a segment loss of $90.8 million.

Wesco Aircraft reported sales, including fasteners, declined to $1.48 billion, while operating income improved to $159 million and net income increased to $91.4 million.

Würth Group reported sales increased 7.1% to EUR 11.84 billion (US$13.1b) in 2016, boosted by online sales.

Würth’s annual operating result increased 14.3% to EUR 600 million, enhanced by higher productivity and cost reductions. South and Eastern European Group companies did “exceptionally well,” compensating for the difficult market situation in Western Europe and North America.

FIN subscribers can read full company results, including figures from the last nine years, by clicking on FIN STOCK REVIEW at GlobalFastenerNews.com.

There are no comments at the moment, do you want to add one?

Write a comment