Stock Report: SIMPSON MFG

FIN STOCK REPORT

Stock Report: SIMPSON MFG

![]()

2014

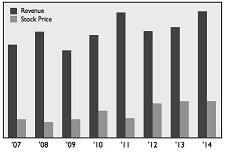

Simpson Manufacturing Co. reported sales, including fasteners increased 4.1% to $166.6 million for the fourth quarter of 2014. Net income rose 35% to $10.4 million, while net income per common share grew 31% to $0.21.

Full-year sales increased 6.6% to $752.1 million, with net income up 24.5% to $63.5 million and diluted net income per common share up 22.8% to $1.29.

Simpson net sales increased in 2014 in all segments, with North America reporting the largest increase, primarily due to increased unit sales.

North America sales increased 7.2% to $613.8 million. Sales in Europe increased 4.6% to $123.2 million, with gross profit up 8% to $46.9 million. Sales in Asia gained 2% to $15.1 million, with gross profit up 34% to $3.6 million.

2013

Simpson Manufacturing reported sales increased 10.8% to $160.3 million in the fourth quarter of 2013, while net income grew 30% to $7.7 million.

The revenue gain included increased sales in the North America and Asia/Pacific segments, with North America reporting the largest increase in dollars.

Full-year sales increased 7.5% to $706.3 million, with net income grew 22% to $51 million.

North America sales improved 9.5% to $572.8 million in 2013. Net sales in the U.S. increased despite reduced home center business and lower selling prices. Canada sales fell due to lower volumes.

Europe net sales decreased 3.9% to $118 million, hurt by lower selling prices.

Capital expenditures totaled $23.4 million, including $19.4 million in the U.S.

2012

Simpson Manufacturing Co. reported sales increased 10.7% to $144.7 million in the fourth quarter of 2012, with net income gaining 20% to $5.9 million, which included a $9.9 million tax benefit.

Q4 sales increases in Europe rose 13% to $28.3 million, primarily due to sales from the recent acquisition of S&P Clever in Europe, partly offset by decreases in France and the U.K.

Overall 2012 net sales increased 8.9% to $657.2 million, boosted by recent acquisitions and increased volumes. Full-year net income fell 17.5% to $42 million.

Full-year North America gained 10% to $522.9 million and European sales increased 4% to $122.5 million.

2011

For 2011, net sales increased 8.6% to $603.4 million, with incoming growing 13.6% to $50.9 million.

Full-year sales increased in the U.S. with above-average increases in the southeastern region, while sales in Canada dipped. Sales to contractor distributors, dealer distributors, lumber dealers and home centers increased.

Gross margins slightly increased from 44% in 2010 to 44.9% in 2011, primarily due to slightly lower factory overhead costs.

R&D expense increased 22.6% $25.9 million in 2011, including increases in personnel costs of $1.9 million, cash profit sharing of $0.9 million and professional services of $0.8 million.

In December 2011, Simpson purchased certain assets of Fox Industries Inc. for $8.7 million. Fox Industries manufactures construction products for concrete. Simpson said the acquisition would help it expand in commercial, industrial and infra-structure construction markets.

Also in December 2011, the company purchased the assets of Automatic Stamping LLC for $42.5 million.

2010

Simpson Strong-Tie sales, including fasteners and anchor systems, increased 3.9% to $119.6 million during the fourth quarter of 2010.

Losses from operations increased 82.8% from $1.0 million in the fourth quarter of 2009 to $1.9 million in the fourth quarter of 2010, primarily due to increased operating expenses, including increased stock options expense of $1.7 million associated with stock options expected to be granted in 2011 and a goodwill impairment charge of $6.3 million, partly offset by increased gross profit.

Q4 sales were mixed throughout North America and increased slightly in Europe. Sales increased in the U.S. with above average increases in the midwestern, southeastern and northeastern regions as compared to the fourth quarter of 2009, partly offset by decreases in the western region and California.

Sales in Canada decreased, while sales grew in France and the United Kingdom, partly offset by a decrease in Germany.

For 2010 net sales increased 5.5% to $555.5 million. Income from operations soared 149% to $78.4 million in 2010, primarily due to increased gross profit, partly offset by increased operating expenses, including the goodwill impairment charge taken in the fourth quarter and increased stock option expense of $1.6 million.

Simpson recorded a loss from discontinued operations, net of tax, of $16.2 million for 2010.

In 2010 sales increased throughout most of North America and Europe. The growth in the U.S. was strongest in the midwestern and northeastern regions, while sales in California and the western region declined slightly as compared to 2009.

Sales in Canada increased significantly.

Gross margins increased to 44% in 2010, primarily due to lower manufacturing costs, including lower costs of material, labor and overhead, and increased absorption of fixed overhead, as a result of higher production volumes.

2009

Simpson Strong-Tie sales, including fasteners and anchor systems, grew 13.4% during the opening quarter of 2010, with sales to distributors and home centers increasing as homebuilding activity picked up.

Overall sales at parent company Simpson Manufacturing Co. gained 12.2% to $133.9 million, while net income increased to $9.2 million compared to a net loss of $8.4 million for the first quarter of 2009.

Simpson Strong-Tie sales fell 22% during 2009, with sales to distributors and home centers contracting due to continued weakness in the U.S. housing market.

During the final quarter of 2009 Simpson Strong-Tie revenue slipped 7.5% as sales to distributors “decreased significantly.”

Overall sales at parent company Simpson Manufacturing Co. dropped 22.7% to $585.1 million, while net income plummeted 77% to $12.2 million. The company recorded full-year sales declines in the U.S., while sales in Europe and Canada grew in the final quarter. During 2009 Simpson reduced its workforce by more than 14% to 2,138 employees.

2008

Simpson Strong-Tie’s 2008 sales decreased 9.2% to $676.7 million, adding to companywide sales declines that forced “significant” layoffs. Gross profit slipped 8% to $272 million, while R&D rose 6% to $20.1 million.

Overall Simpson sales in 2008 decreased 7.4% to $756.5 million, while net income dropped 21.5% to $53.9 million.

In April 2008 Simpson Manufacturing Co. acquired certain assets of Liebig International and its subsidiaries in Europe and the U.S. for $18.3 million. Liebig manufactures mechanical anchor products in Ireland and distributes them in Europe through warehouses located in Germany and in the UK.

HISTORY

In 2007 Simpson Strong-Tie acquired Swan Secure Products, which makes and distributes stainless steel fasteners.

Simpson Strong-Tie designs and manufactures wood-to-wood, wood-to-concrete and wood-to-masonry connectors and fastening systems and pre-fabricated shearwalls.

Corporate Office: 5956 W. Las Positas Blvd., Pleasanton, CA 94588. Tel: 925 560-9000

Web: simpsonmfg.com

CEO: Karen Colonias

Employees: 2,434

©2015 GlobalFastenerNews.com

There are no comments at the moment, do you want to add one?

Write a comment