Supply Disruptions To Continue Through 2022

If you expected supply chain disruptions to disappear at the start of next year, now is a good time to moderate your expectations.

“2022 is going to mirror 2021 from a supply point of view,” Michael Selman, sales rep for Beta Steel, Beneke Wire and Monarch Metals, told the National Fastener Distributors Association.

Freight remains a major issue exacerbated by a shortage of drivers that affects all markets.

And don’t expect a market shift now that the White House has replaced the 232 tariffs with steel quotas for the European Union.

“Lifting the 232 tariffs will not have a huge affect on the market,” Selman explained.

Cold heading quality steel (CHQ) is generally available at higher prices, though the delivery wait has doubled to eight weeks. That delay has extended customer deliveries to 14 to 16 weeks.

Cold heading quality steel (CHQ) is generally available at higher prices, though the delivery wait has doubled to eight weeks. That delay has extended customer deliveries to 14 to 16 weeks.

“If you place an order now, lead times go into February,” Selman noted.

To survive the current conditions, Selman advised distributors to “stay strong with your suppliers.”

“Supply chains are strained but not broken.”

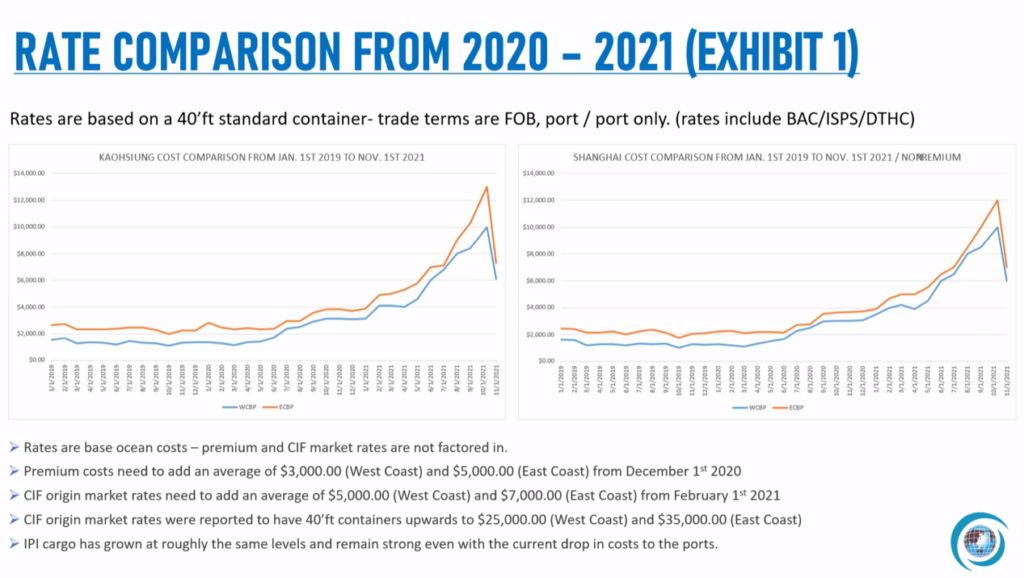

Shipping rates have gone up 500% or higher (up to 1000% based on destination), according to Chris Donnell, national sales director for Scanwell Logistics International.

“For the next 3-6 months, rates should remain relatively stable.”

However, in 2022, the Chinese New Year and the upcoming Beijing Olympics will cause rates to increase.

Currently, carriers are ignoring any pricing structure agreements signed before the shipping season.

“Before the pandemic, ocean carriers were losing money, so now they’re trying to make as much as they can,” Donnell explained.

In 2022, ports will begin charging a $100 storage fee to ocean freighters after 7 days for freight is in port; that rate increases $100 every day after that, with freighters saying they’ll pass those costs on to customers.

Frustrated with ocean freight, many importers are switching to air freight.

Meanwhile, truck shortages are accelerating. Ports are refusing to let drivers return empty containers, tying up trucks for days before they can haul full containers.

These conditions are occurring amid a one million truck driver shortage nationwide. Economists now see 2026 as when there will be enough drivers to handle domestic freight.

There are no comments at the moment, do you want to add one?

Write a comment