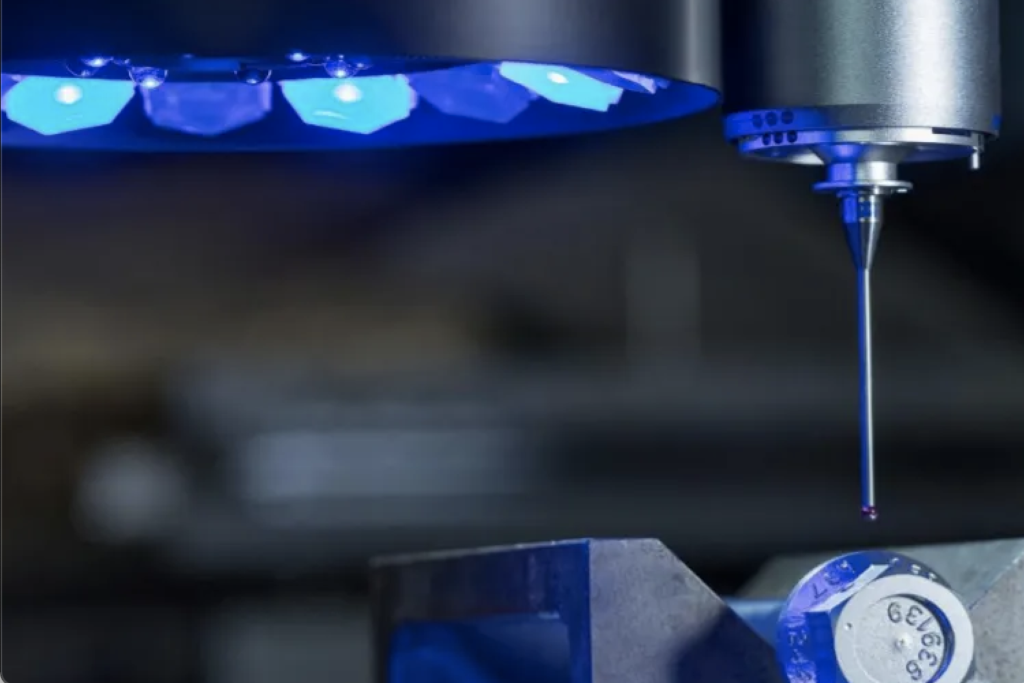

LISI Aerospace Sets Up Smart Fastener Facility

LISI Aerospace and the University of Sheffield Advanced Manufacturing Research Centre (AMRC) jointly secured £975,000 (US$ 1.34 million) in funding from the Aerospace Technology Institute (ATI) to “unlock productivity gains, new markets and reduce waste in the fastener industry” through the integration of Industry 4.0 technologies.

The pilot production line for high-precision aerospace fasteners, at BAI UK’s Rugby facility, will help define the “smart factory” by pioneering the use of machine learning, data analytics, indirect fault detection and other cutting-edge digital technologies.

The goal is to deliver a smart, dynamic manufacturing line that minimizes waste, improves worker safety and efficiency and sets a new benchmark for productivity in the aerospace fastener industry.s

“The investment shows that BAI UK are committed to advancing the fastener industry with a unique and impactful approach; the award of ATI funding adds credibility to that ethos,” said Mark Capell, general manager of BAI UK.

The company is part of LISI Aerospace – the third largest supplier of aerospace fasteners globally, who are searching for proactive steps they can take to lead their industry through innovation in the face of international competition, tighter margins and an aging workforce.

The company is part of LISI Aerospace – the third largest supplier of aerospace fasteners globally, who are searching for proactive steps they can take to lead their industry through innovation in the face of international competition, tighter margins and an aging workforce.

“The project goes far beyond the technology, it serves as an investment in the remarkable manufacturers in the UK, the fantastic workers we employ, and does so in a more environmentally sensitive way,”Capell added. “The project will reduce wastage and operator interaction; ultimately aiming to provide an all-round better manufacturing process.”

Part of the High Value Manufacturing (HVM) Catapult, the AMRC is a leader in manufacturing research, with specific expertise around Industry 4.0 technologies at its flagship Factory 2050 in Sheffield.

“This project shows the value of Industry 4.0 to all levels of the UK supply chain and has the potential to break down barriers to technology adoption which can push UK manufacturing into a new era,” stated Gavin Hill, project manager at Factory 2050.

“Implementing these technologies is also a chance to reduce environmental impact by reducing waste and providing the data for LISI to understand where they are wasting energy and where they can get better life out of tooling and consumables in a more sustainable way.”

BAI UK and the AMRC will work with machine builders and tooling providers throughout the 27-month program to streamline the technology introduction process, as well as investigate how these technologies can add value to both aerospace and the manufacturing world.

ABC Marks 40th Year of TruFast Brand

During 2021, Altenloh, Brinck & Co. US, Inc. is marking the 40th anniversary of the TruFast brand, which was founded in the farm fields of rural Ohio.

ABC manufactures TruFast for exterior building envelopes and facades and Spax engineered fasteners for construction.

The story of TruFast is chronicled in founder Duane Spangler’s book, The Journey. TruFast initially produced fasteners for the commercial roofing industry.

TruFast was acquired in 2005 by German-based Altenloh, Brinck & Co.

ABC’s acquisition led to a 33,000-sq. ft. expansion and modernization of the Bryan, OH, manufacturing facility in 2011 and a 50,000 sq ft expansion of its heat treat facility in Pioneer, OH.

CEO Nikolas Dicke of ABC observed that the two companies had “similar brand traits: customer focus, persistence, high quality and reliability of both our products and people.”

Spax brand president Jim Winn said, “TruFast is the foundation that the Spa brand was built on. The family environment of ABC has never been “more evident than during the global pandemic of 2020. We make high quality, highly engineered products but the quality and longevity of our people are what set this company and its brands apart the most.”

TruFast president Jason Beals noted the manufacturer has added 200 jobs and acquired additional brands including Rodenhouse. “We will make and sell more than one billion screws this year,” Beals predicted.

Beals recalled $10 million once “would have been a great year,” but now ABC U.S. sees $10 million in a month.”

ABC has distribution facilities in Michigan, Texas, Florida, California and Ohio, and is headquartered at 2105 County Rd. 12C, Bryan, OH 43506-8301. Tel: 419 636-6715 Web: TruFast.com or Altenloh.us

Sachs: ‘Perfect Storm’ Creates Container Shortage

“The cost of the containers have increased dramatically over the past 12 months,” Bob Sachs of XL Screw said. The shortage is due to a “perfect storm” created by a list of reasons for container shortage.

“The steamship lines are really taking advantage of the situation and they are reportedly making record profits,” Sachs said. “They are very happy.”

Reasons for the container shortage include “empty containers sitting all over the world waiting to be shipped back to the Far East. Not enough cargo to be shipped back to the Far East,” Sachs explained. “This creates a lack of container availability to ship back to the USA.”

• The pandemic also contributes to the container shortage: “Because business slowed down so dramatically last year, I heard that the companies that make new shipping containers cut way back on their new production,” Sachs noted. “Now they can’t keep up with the demand.”

• Demand for container space had increased toward the end of 2019 with the economies of the world doing well, Sachs pointed out. “Companies needed to replenish their inventories due to improvement of the demand for product worldwide.”

• PPE products are especially in demand now and “governments are paying a hefty price to the steamship lines to move the PPE cargo.”

Sachs termed giving PPE cargo priority “understandable.”

• Sachs’ fourth reason for the container shortage is steamship lines “cutting way back on their vessel sailings to create a demand on container space thus taking advantage of the situation and being able to raise their prices.”

“Shipping costs change daily,” Sachs finds.

• Also the upcoming Chinese New Year “always creates a push for available container space,” Sachs added.

The public holiday runs from February 11 – 17, though some companies observe the New Year until February 26.

• Sachs observed “there are so many ships sitting outside the USA West Coast Ports waiting to unload their cargo. This is creating long delays.”

All of those reasons combined have “created the Perfect Storm!” Sachs declared.

When will the container situation ease?

“I have no idea when container availability will improve and when shipping costs will stabilize,” Sachs explained. “There are so many factors created by the Pandemic. These are very unusual times with many unanswered questions.”

“In the past, shortage of container space and large increases in shipping costs typically come and go pretty quickly,” Sachs has found.

“I am afraid to say…not this time due to the uncertainty of the Pandemic and the trade war with China. You just need to come up to the plate and keep swinging.” Web: XLscrew.com

Hariton Machinery Went Global From Its Start 50 Years Ago

Hariton Machinery Company Inc. has completed 50 years by being global from the company’s start in 1970.

The Connecticut-based fastener machinery supplier was “internationally focused,” while competitors limited themselves to the North American market, founder Mark Hariton commented.

Hariton started in the Mexican market and then as the UK was closing fastener plants, he began shipping containers of machinery back from Europe.

He and his sales people continue to make “four, five or six trips a year to Europe, Asia and South America.” Hariton says half of company’s business comes from overseas.

Indeed, his standard “Best regards” closing on his email adds: Atenciosamente, Cordiali Saluti, Saludos, Freundliche Grübe and Bien cordialement.

Including the multiple languages demonstrates “we care about them,” Hariton said. “We respect them. We appreciate them.”

Mark Hariton’s first job was as a technician for AT&T, where he appreciated that the company paid him while he trained.

But after four years he was “bored” and sought another outlet for his mechanical aptitude. He ended up with a small family company led by three brothers. He was assigned different jobs, including handling lathes and presses. Beyond that he had to find his own niche within the company. While looking for potential business, Hariton found a screw company selling used cold headers. That led him to contact the J.L. Lucas business, which handled fastener machinery.

He decided he could do the machinery business on his own and in 1970, Mark Hariton and wife Sue opened Hariton Machinery in the basement of their Long Island, NY, home.

A year later they rented an office and next bought a 6,000 sq ft warehouse and office in Oceanside. In 1991 they bought a 80,000 sq ft industrial building in Bridgeport, CT – where Hariton Machinery remains today.

While metal cutting has “revolutionized,” cold forming and hot forming has “evolved,” Hariton observed. That allows used machinery to hold value vs. becoming obsolete. He still sells used Waterbury Farrel machines built over 40 years ago.

“There are machines from the 1920’s and 1930’s that are still functioning,” Hariton noted. “Manufacturers worldwide are still buying and using them.”

Of course Hariton sells new machines as the exclusive USA agent for SACMA Machinery of Italy; Shimazu Tapping Machines from Japan; and Tecno Impianti wire drawing machines from Italy. Hariton Machinery is the international agent for Jehren Industries of Rockford, IL.

Tough spots along the way? “Every 10 years or so there is a recession and recessions are always a challenge,” Hariton observed. Surviving requires being “creative, tough and optimistic.”

Will operators be able to work from home or be replaced by robots? Hariton doesn’t see that happening. “There is an art to it in cold forming. There is a lot of skill involved. Operators need the ability,” Hariton explained.

However, there will continue to be more computerization, he predicted. Customers want machinery that is easier to setup, change over and higher speed production.

Change ahead? Hariton advised the fastener industry to keep its eyes on electric vehicles. As the world gravitates to more electric vehicles, be aware that electric motors that drive the vehicles require fewer fasteners than the internal combustion engines, Hariton pointed out.

Mark Hariton has his 50+ years in the business and his son, Alan Hariton, and nephew, Michael Coda, have more than three decades each with Hariton Machinery. Also Michael Carelli has more than 30 years.

“We’re very proud we survived and ready for a new generation,” Mark Hariton told GlobalFastenerNews.com.

Hariton Machinery Company Inc. is located at 810 Union Ave., Bridgeport, CT 06607-1137. Tel: 203 367-6777 Web: HaritonMachinery.com

BAIFD: Freight Container Shortage Causing Fastener Price Hikes

Last December, the British & Irish Association of Fastener Distributors warned that a shipping container shortage at major global export ports was limiting fastener availability in the UK and Ireland, hiking container freight costs three-fold.

BIAFD sees little chance of significant improvement in availability or freight costs until the second quarter of 2021, director Phil Matten said.

Freight cost increases combined with rising steel and stainless steel raw material costs mean fastener costs will increase significantly, he predicted. The current situation is significantly worse.

“The problem is global, and not directly related to the UK leaving the EU,” Matten told the BAIFD. “That said, issues at Felixstowe Port, which knocked onto other UK ports, have exacerbated an already critical situation.”

The escalation of Covid-19 infections in the UK now also means shipping lines continue to avoid British ports, preferring to off-load in Northern European, which adds a two-week delay in goods arriving in the UK, Matten added.

The latest reports from BIAFD importing members show Asia-North Europe container freight costs have jumped five times higher than mid 2020, Matten reported. For a container of standard fasteners with a low value per weight, the freight cost now equals a third of the value of the consignment.

Some BIAFD members have decided it is too expensive to import now, “even though current inventory is rapidly eroding to support increased demand from construction and manufacturing,” Matten reported. Most fastener importers are competing against high value consumer goods for scarce containers and being forced to pay massive premiums.

There are additional charges of several hundred dollars to ensure a container is collected in time to be loaded for shipping.

There are signs of limited improvement in container availability in key Asian exporting ports as shipping lines reposition empty containers while container manufacturers struggle to supply new boxes, Matten reported. However, there is “little immediate prospect of major improvement,” with the 16-day Chinese New Year beginning February 12. The holiday means a surge of export activity ahead of factory closures, increasing pressure on extremely limited container capacity, followed by several weeks of catch up, once factory, haulage and port operations return to work.

As early as the second week in January, freight agents told BIAFD importers that there was no possibility of their containers being shipped before the Chinese New Year.

While governments may be losing patience with shipping rates and supplementary charges, “threats of capping shipping costs or competition authority investigations are currently doing little more than shaving the very tip of the iceberg,” Matten concluded.

The British & Irish Association of Fastener Distributors represents 85 UK and Ireland fastener importers, wholesalers and distributors. Web: BIAFD.org

Fastener Fair Stuttgart 2021 Postponed

The 9th International Exhibition for the Fastener and Fixing Industry has been postponed from May to November 9-11, 2021, in Stuttgart, Germany.

“This decision was taken in light of the ongoing Covid-19 pandemic and following conversations with all exhibitors and visitors that have taken place over the past weeks and months,” show owner Mack Brooks Exhibitions announced in a press release. “Uncertainties around continued travel restrictions were also a contributing factor to this decision due to the truly international character of the Fastener Fair Stuttgart show.”

Liljana Goszdziewski, portfolio director for the world’s largest fastener trade show, said “extensive conversations with all participants” led to the postponement. “Based on the current international developments due to the Covid-19 pandemic, covering further lockdown and travel restrictions, we believe that it is the most responsible decision at this stage to postpone. This early announcement will hopefully allow time for the impact of COVID-19 across the world to stabilize and when safe to do so, ensure that the event can continue its critical role in bringing the global fastener and fixing industry together again.”

Last week Fastener Fair USA was postponed from June to dates that will overlap with Stuttgart: November 8-10, 2021, in Cleveland.

Mack-Brooks announced it will delay Fastener Fair Italy, scheduled to take place during the same dates in November.

The Fastener Fair Stuttgart team “will communicate closely with customers and partners over the coming weeks and months and thank their exhibitors, partners, suppliers and visitors for their support during this challenging time.”

Fastener Fair Stuttgart is part of a series of trade shows in Italy, Turkey, France, India, Mexico and the U.S. Web: FastenerFair.com

2021 Fastener Trade Show Schedule

The Covid-19 pandemic has pushed 2020 and 2021 fastener trade shows to the second half of 2021, creating a crowded schedule.

Here are the latest 2021 dates for North American trade shows:

Mid-West Fastener Association

August 16-18

Monday 75th anniversary event at Venuti’s in Addison, IL; 39th Table Top on Tuesday, Belvedere Banquets, Elk Grove Village, IL; 68th Golf Outing on Wednesday

Web: MWFA.net

Metropolitan Fastener Distributors Association

September 11-13

Opening reception on Saturday; golf on Sunday; and Table Top on Monday. Ballyowen Golf Club & Crystal Springs Resort.

Web: MFDA.us

International Fastener Expo

September 21-23, Mandalay Bay, Las Vegas

Golf, conferences and opening reception on Tuesday; trade show Wednesday and Thursday

Web: FastenerShows.com

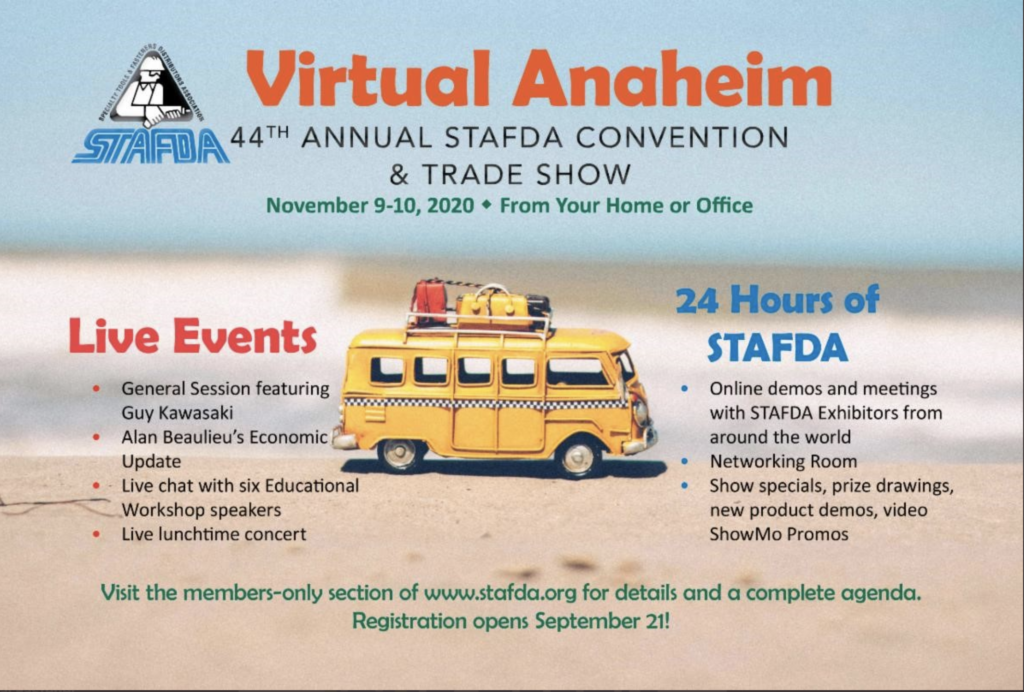

Specialty Tools & Fasteners Distributors Association

November 7-9, Charlotte Convention Center

Conferences and opening reception on Sunday; Keynote and State of the Industry addresses on Monday;

Trade show Monday and Tuesday.

Web: STAFDA.org

Fastener Fair USA

November 8-10, Huntington Convention Center, Cleveland

Conferences on Monday, trade show on Tuesday and Wednesday.

Web: FastenerFair.com

There are fastener trade shows worldwide during this period. Among them: The world’s largest is Fastener Fair Stuttgart, which is still slated for May 18-20, 2021, in Germany. Currently Fastener Fair Mexico is still scheduled for June 29-30. The Taiwan International Fastener Show has been postponed from 2020 and is now scheduled for September 1-3, 2021.

Fastener Fair USA Postponed Again

Fastener Fair USA is being postponed again, this time from June 2021 to November 8-10, 2021, in Cleveland.

“After extensive consultation and ongoing monitoring of the COVID-19 pandemic, we have made this decision with the wellbeing of all our customers and partners as our highest priority,” said Marie Brown, group VP for Reed Exhibitions. “We are developing additional channels and digital tools to complement the live event in order to serve the industry, support our loyal exhibitors, and to ensure our attendees have access to find the solutions they need.”

Fastener Fair USA was first held in Cleveland in 2018, followed by Detroit the next year. The third Fastener Fair USA was originally scheduled to be in Charlotte in 2020. The pandemic forced postponements and eventually the 2020 show was dropped.

Fastener Fair USA includes exhibits for manufacturers, wholesalers, distributors and suppliers of fastener and fixing technology.

Earlier Fastener Fair USA had announced that the International Fastener Manufacturing Exhibition is joining the 2021 trade show. Web: ifmsainfo.com

The trade show launched Connector365 last year as a year-round online platform, a repository of thought-leadership, and industry expertise. The platform can be used to search the show directory of leading suppliers, stay up to date on fastener industry news, and hear the latest from our industry partners.

“In the coming months, Fastener Fair USA will feature more 365 digital promotional opportunities and a significantly enhanced Connector365 platform for attendees and industry professionals,” event director Bob Chiricosta said.

In addition to exhibits, there are technical conferences, demonstrations and networking opportunities. For information: FastenerFairUSA.com Email: bchiricosta@reedexpo.com Tel: 617 417-0351

Fastener Fair USA is owned by Reed Exhibitions, which conducts 500 events in 30 countries across 43 industry sectors, attracting more than seven million participants. Reed is part of RELX, a global provider of information and analytics for professional and business customers across industries. Web: ReedExhibitions.com

Cohn Sells Duncan Bolt to ESOP

Andy Cohn announced the sale of Duncan Bolt to an Employee Stock Ownership Plan.

Founded in 1953 by David Duncan, the Southern California-based fastener distributorship is now headed by general manager Steven Somers, and the team of Norris Glantz, Andrew Bengis, James Socrates and David Glantz will lead the distributorship.

Founded in 1953 by David Duncan, the Southern California-based fastener distributorship is now headed by general manager Steven Somers, and the team of Norris Glantz, Andrew Bengis, James Socrates and David Glantz will lead the distributorship.

Duncan Bolt president Andy Cohn and vice president Virginia Cohn are retiring.

Andy Cohn started in the fastener industry at ground level: Sorting hex nuts with his New York neighborhood friends for $15 a keg for his importer father Eric Cohn of Allied International.

After graduating from Case Western Reserve University, Andy had no intention of a fastener career. He went off to the Bay Area in 1974, but after several months of unemployment, Andy “caved and let Eric help him find a job.” That put Andy at Bay City Screw & Bolt in San Carlos, CA. He started as the “kid” who packaged and filled orders. He graduated to answering telephones.

Those were the days when distributors would buy either domestic or imported Grade 5, but Grade 8 had to come from Lake Erie Screw or the new domestic manufacturer, Nucor Fastener, Cohn recalled.

Andy “got hooked” on the fastener industry, and in 1976 Eric called to say Allied International was opening an American Eagle branch warehouse in Denver. Andy accepted the role of Rocky Mountain regional sales manager.

While with American Eagle, he met and married Jeannie Walker of Fasteners Inc. and went to work for John Walker at Fasteners Inc. for six years until divorcing.

Cohn moved back to New York and, after Allied International was acquired, he was asked to relocate to Allied’s Southern California operations.

That was at a time when the early importers were expanding and diversifying.

“lt was a time of ‘fast change’ for importers,” Cohn recalled.

He also met and married Virginia, daughter of Luke Sullivan of Sullivan Bolt.

By 1986 Cohn had set a goal of becoming a distributor – “to get into the distributor business and live happily ever after,” he smiled.

Cohn heard Dave Duncan – who had recently remarried at age 81 – wanted to retire. Cohn called and Duncan suggested, “Come talk to me.”

“It jelled,” Cohn recalled. “We put together a good deal, with good terms.” The Cohns took over in 1988. Duncan veteran Marlene Mathieson stayed over with the new owners.

At the time, Duncan Bolt was located in a 20,000 sq ft metal building in Huntington Park, which was the industrial sector south of Los Angeles. Half of the customers were OEMs and the other half were distributors.

Duncan Bolt succeeded at stocking Castle nuts and other C and D items some importers “sneered at,” Cohn recalled.

Duncan Bolt grew and moved to a larger space 9.6 miles away in Santa Fe Springs – a newer industrial area – in 1999. By 2010, Duncan Bolt took over a neighboring building.

A year ago, four key employees approached Cohn about an ESOP.

Cohn noted that ESOPs usually don’t provide the seller with top dollar, but there are capital gains tax advantages.

And there is something that “feels good” about selling to employees who helped build the distributorship, Cohn emphasized.

“It is less brutal than selling to the highest bidder and announcing to employees, “Oh, by the way, you now work for Fred.”

During his 46 years in the fastener industry, Cohn was the 2001-2002 president of the Western Association of Fastener Distributors, a co-founder of the Fastener Education Fund and a board member of the National Fastener Distributors Association.

Duncan told FIN that the biggest change in the fastener industry during his career was the sourcing of imported fasteners from Japan to Taiwan to China. He watched as the world moved away from domestic fasteners.

As he departs the fastener industry, the major question of 2020 started with “Are they making bolts in China this week?” to “Will there be vessels arriving with bolts?” Inventory on the shelves has gained value, Cohn pointed out.

Cohn will continue as a Duncan Bolt board member. Messages may still be sent to him: 1951Andy@gmail.com.

Duncan Bolt opened a branch in Phoenix in 2003 and is headquartered at 8535 Dice Rd., Santa Fe Springs, CA 90670-2509. Tel: 800 798-1939 Web: DuncanBolt.com

Container Shortage Impacting Fastener Supply Chain

A shortage of shipping containers at major global ports is now seriously impacting fastener availability in the UK and Ireland, the British & Irish Association of Fastener Distributors warns. The crisis is also forcing up container freight costs three-fold and exacerbating other cost drivers to fuel sharp product inflation.

Container shortages are currently the biggest disrupter according to specialist supply chain media The Loadstar1 on 1st December. BIAFD importer members say they now have major backlogs at factories, which cannot be shipped to the UK and Ireland due to the lack of containers.

Container shortages are currently the biggest disrupter according to specialist supply chain media The Loadstar1 on 1st December. BIAFD importer members say they now have major backlogs at factories, which cannot be shipped to the UK and Ireland due to the lack of containers.

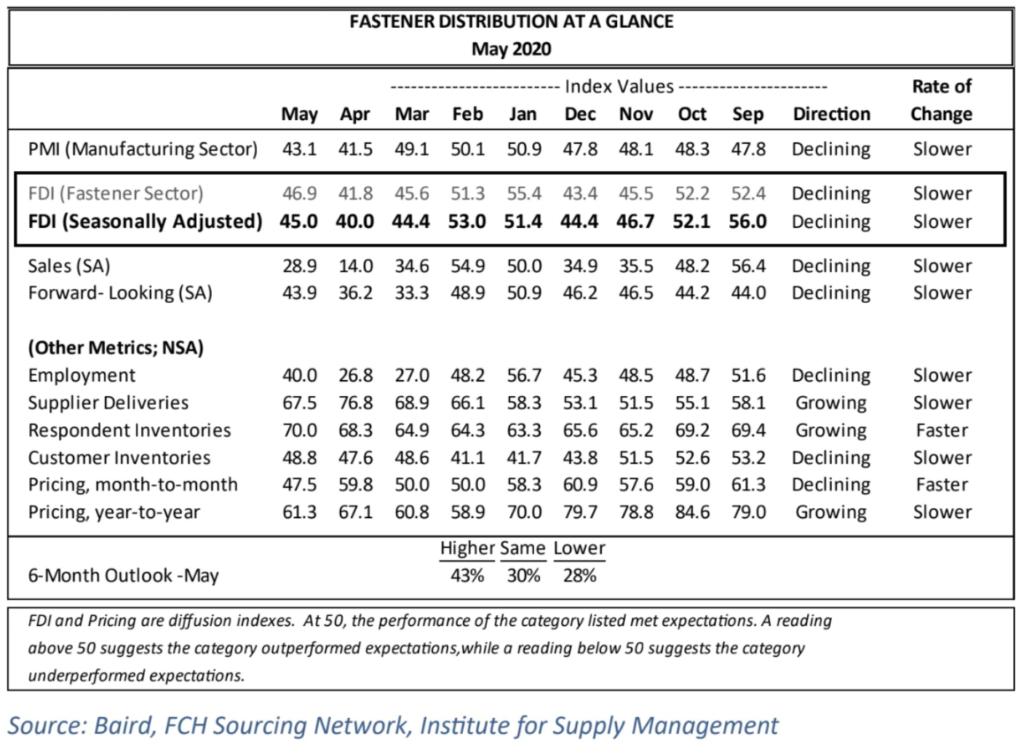

The CAx, an index of container availability, is now at record low levels. A reading below 0.5 indicates a deficit of containers. For week 49 the reading for Shanghai Port was just 0.03 – compared with 0.53 ten weeks previously, and 0.66 in week 6 of 2020. The indices for other global – and also European ports – show plunging container availability over recent weeks.

“The container shortages are an indirect consequence of the Coronavirus pandemic,” according to BIAFD. “Emerging early from the pandemic, Chinese factories recovered production and recommenced exports to global markets.

“More recently, export shipments increased ahead of the Chinese National Day holiday in October, further ratcheting during the peak season run-up to Christmas.”

Container return times to ports in all import markets have significantly increased due to coronavirus-related shortages of vehicles and drivers.

Container shortages have also been exacerbated by the volumes of personal protection equipment being imported, BIAFD reports. Many of these containers have now been moved to inland storage points but the containers are unlikely to be released for many months and potentially longer.

“With finances hit hard by the collapse of global trade, resulting from the pandemic, shipping lines radically tightened capacity on most routes. Lack of capacity and low backhaul profitability has meant containers returning to export markets far more slowly.”

More lucrative transpacific routes to American markets have also taken priority for both container ships and containers over European routes.

While container manufacturers have increased production, output lags well behind demand, with the knowledge that the container market will eventually rebalance a disincentive to further ramping up output.

“All the indications are that it will be several months before equilibrium is restored. With backlogs rapidly growing at exporters and an early Chinese New Year putting further pressure on capacity, it looks improbable the situation will return to any level of normality until the end of quarter one 2021.”

Some carriers have applied substantial port congestion surcharges, further adding to importers’ costs. BIAFD importers report container freight costs tripling, without factoring in port surcharges or costs of rerouted shipments. This means an effective on-cost to products often in excess of 10%.

Other inflationary pressures on fastener costs were already becoming evident.

“Asian steel prices have increased sharply in the last month, with further increases predicted, as supply tightness is compounded by a serious accident in a major Korean steel plant,” BIAFD reports.

European steel lead times have also extended sharply, for some wire grades tripling to more than twenty weeks, and steel producers are expected to introduce substantial cost increases early in 2021.

The British & Irish Association of Fastener Distributors represents the interests of more than 85 United Kingdom and Ireland fastener importers, wholesalers and distributors. Web: BIAFD.org

IFI to Mark 90th Anniversary At October 2021 Meeting

The Industrial Fasteners Institute has scheduled its annual spring meeting for March 6-9, 2021, in Scottsdale, AZ.

Managing director Dan Walker acknowledged the IFI would normally have celebrated its 90th anniversary at its spring meeting, but he anticipates attendance “will be hampered by virus fears,” so the 90th will be marked during the October 3-5 meeting at the Peabody Hotel in Memphis.

Walker said he is hopeful the COVID situation “will be under control” by October and “our attendance is suitable for the celebration.”

If necessary, the spring meeting will be switched to virtual, Walker said.

The 2020 autumn meeting planned for Memphis was held in virtual format instead.

The IFI also conducts automotive and aerospace division meetings and member-only training events. For IFI information: Tel 216 241-1482 Web: IndFast.org

2020 Cybersecurity Threat Trends For Business

Supervisory Special Agent K.C. Bixby of the FBI summed up 2020 with this statement:

“It feels like the entire world has changed,” he told Mid-West Fastener Association members during a video conference on cybersecurity in November.

But some cyber tricks and scams remain the same, stated SSA Bixby, who runs a global cybersecurity squad from his office in Chicago.

“Cyber is integrated into all the different threats we see (at the FBI).”

Those threats include terrorist attacks, foreign intelligence, cyber attacks and high-tech crimes, and public corruption.

“Cyber criminals are active and they are everywhere,” SSA Bixby explained. “They are trading malware. They are collaborating to get the most money for themselves.”

There’s a lot of data loss and lots of money being stolen, especially among the 40 – 60+ age group.

“You’re the target,” SSA Bixby emphasized. “You’re the one with the money that they’re going after.”

In 2019, the FBI reported $3.5 billion in victim losses.

“These are the numbers that are reported. If you’re a company and lose $400,000, you’re gonna report that. If you’re a small mom & pop shop hit with ransomware for $1,200, you’re probably not gonna report it.”

Business email and ransomware are the most prevalent types of attacks, with 95% of computer infections coming through email.

“The way that the bad guys get into your system is through email,” SSA Bixby sated.

Hackers only need one person in a company to click on a suspicious link in an email, so SSA Bixby urged MWFA members to be careful of external links in emails. Users are twice as likely to click on a link than download an attachment.

To protect your business data, it’s also important to keep your antivirus software up to date.

“If a bad guy wants to get into your system, all it takes is time.”

SSA Bixby, who has a masters in clinical psychology and is also an FBI hostage negotiator, said that frequent data backup can help prevent you from paying cyber ransoms.

“When people have live hostages, they will negotiate. With ransomware, they just don’t care. Once that key is gone, your data is gone.”

Just because your computer doesn’t shut off immediately after you click a suspicious link does not mean you haven’t been infected.

“It’s not always enterprising criminals,” SSA Bixby explained. “Sometimes it’s nation states trying to disrupt international commerce.”

In the event your company is hacked, the FBI does not support paying a ransom.

“There’s no guarantee you’ll get your data back, and once you pay, the FBI is not able to get your money back.”

To prevent ransomware attacks, it’s important to research the source of every link and go directly to the source instead of activating the link, which could allow hackers to infiltrate your computer. In addition, never download files from sources you don’t trust.

Other tips include:

- Robust patch management;

- Two-factor authentication for any remove access to your network;

- Don’t use the same local administrator password across all systems;

- Make regular data backups that are stored on a separate network;

- Have a complex 15-character password and keep it.

“The old advice of changing passwords every 90 days led to people creating simpler passwords and writing them down.”

New cyberthreat trends including BYOD – people bringing personal devices to work.

“It’s no longer an ‘if.’ It’s just a matter of time before your company is targeted.”

Hughes to STAFDA: Underdogs Can Win

Can small distributors compete against Amazon? the president of the Specialty Tools & Fasteners Distributors Association asked in his 2020 virtual State of the Industry speech.

“We. Are. The. Underdog,” emphasized Greg Hughes, president of Kinnunen Sales & Rental. “Well, I’m here to tell you: Our. Dog. Bites!”

“We. Are. The. Underdog,” emphasized Greg Hughes, president of Kinnunen Sales & Rental. “Well, I’m here to tell you: Our. Dog. Bites!”

The Oklahoma distributor’s mascot is a dog.

“I love being the underdog,” Hughes declared. “I love the challenge of someone saying that I can’t. And in our industry the Big Boys are telling us just that. That we can’t keep up with their ability to attract and keep this next generation of buyers.”

“What the pandemic did was force our brick-n-mortar customers to find ways to ‘per – fect’ their internet buying skills, Hughes said.

The customer base is growing younger and “their online love affair grows stronger each day, subsequently kicking our counter-and-field-based customer service to the curb, and the big box stores have increasingly aggressive B2B programs.”

“Our customers may be convinced they don’t need us anymore. Are they correct? I mean, we can’t out-Amazon, Amazon. Right?”

After college in Oklahoma, Hughes learned direct selling of fastening-related products to end users with a German-based company. Within two years he became an outside salesperson.

“The next few years I learned the art of selling, and I started developing key relationships, one of which was with a hard-working and determined gentleman by the name of Ray Kinnunen,” Hughes recalled.

Kinnunen, a concrete contractor by trade, “had grown tired of driving so far to obtain rental equipment and supplies. So with a $400,000 loan and a 4,000 sq. ft. building, he started Kinnunen Sales & Rental, offering a few pieces of rental equipment and some concrete related supplies, including the shots, pins, anchoring and drilling products my company offered.”

“I call these my ‘Tailgate Years’,” Hughes described working with Kinnunen. “He’d always ask me to sit on the tailgate and have a talk. Eventually he started visiting with me about taking a sales position with him to grow his company.” Hughes recalled being reluctant to leave the sales job he was doing well at, but “Ray cast a vision about what the future could look like. He was passionate about my future, and as he saw it, that future should be with his company. Ray made the dream come to life; he convinced me to make another change – another decision that would alter my life forever. I accepted his offer.”

Hughes and Kinnunen attended STAFDA and World of Concrete trade shows, “begging vendors to take a chance on us.” “But over the years we built a business from the ground up.” In 2013, Hughes and his spouse bought the distributorship from Kinnunen.

“Our slogan at Kinnunen Sales & Rental is – ‘Getting You Back to Work’ – and we’ve built a business on that promise.” That required getting the customers and retaining them when they “have the option to purchase our products not only faster, but also in some cases, cheaper from Home Depot, Lowes, Amazon, and whomever pops up online overnight.” “We’ve accepted the fact that in the next five years nearly 75% of our customers – those people we depend on to stay in business – will be Millennials and Gen Z-ers. We’ve ditched the old-guy gripe about how we hate change, or how we hate how these youngsters think…and we’ve made change after change after change, to simply….keep up with change.”

Hughes said “opportunities to buy from someone else are only going to continue to multiply as we’ve seen happen at lightning speed in 2020. We’ve got to have reasons for not only our customers, but also our vendors, to hang with us.”

One way the “Kinnunen underdog bites back is by building strong relationships with our vendors. Let’s all agree – our vendor partners have a responsibility to their companies, their employees and shareholders to produce results. To that end, servicing the big box stores and various online platforms due to their sheer volume is an option they are unable to pass up, but you know what? Our vendors love us and they know what we bring to the table. We’re the guys who will take the vendor to the jobsite and get their brain and heart involved in our projects. No one at the big box stores or online giants are going to do that. We’re going to make sure our vendors know our partnerships with them are a huge part of our ability to succeed. They are going to feel, see and understand how much we need them, appreciate them, and depend on them to help us take our market share back. That’s just one way the underdog bites back.

Hughes noted many distributors saw sales skyrocket this year because of the surge in online buying. “And how did they get so much business? Because of their investment in online and social media platforms. Their willingness to follow the trends of younger buyers – and older buyers – wanting the buy-it-on-my-phone convenience.”

Now before everyone says, “Yeah, but I can’t afford a million-dollar website with apps,” hear me out, I’ve said that same thing for years. The answer doesn’t have to be that difficult or costly but doing nothing is no longer an option, just like doing nothing wasn’t an option in the formative years of your business,” Hughes advised.

“We can’t keep our holier-than-thou attitudes, thinking everyone should come to us because we have a beautiful store on Main Street where the shelves are dusted, the floor is swept, and our employees greet you with a smile,” Hughes said. “We’re going to keep providing those things, but we also have to accept the new religion of apps and online buying trends of this generation, and all future generations.”

“We have to reach a market who, for the most part, we don’t see,” Hughes said. “A market who doesn’t have the time or the desire to sit on a tailgate. We must innovate or dare I say it, become yesterday’s news.

Hughes advised distributors to “talk to each other, network and figure out what your options are.” Use the STAFDA consultants.

“Get out of the ‘what’s the use’ mindset! Everyone listening to this speech has had those moments of, “You know what? The customer either has to walk in here, or call…that’s it.”

“We also have the ability to sell, rent and service a plethora of other things that aren’t available online,” Hughes declared.

“There are a lot of underdogs” listening to the STAFDA speeches. watching this right now. And whether it’s with a website, an app, an attitude or a tailgate…I want to tell you….I’m betting on us. I’m betting on the 945 distributor companies, the 1,050 associate companies and the 280 manufacturer rep companies represented here.”

Johnson Tells STAFDA: Ban Paper in Front Office

Move your distributorship into the future by eliminating paper in the front office, Andrew Johnson advised the Specialty Tools & Fasteners Distributors Association. That includes everything from invoices to the fax machine.

Speaking at a 2020 virtual session of STAFDA’s 44th annual convention, Johnson said as long as there is paper in the front office, the warehouse will come up front to ask questions or for copies. Instead, have them click on computers in the new wireless warehouse for answers from the front office.

Speaking at a 2020 virtual session of STAFDA’s 44th annual convention, Johnson said as long as there is paper in the front office, the warehouse will come up front to ask questions or for copies. Instead, have them click on computers in the new wireless warehouse for answers from the front office.

Johnson, CEO of Shelfaware LLC and a multiple generation distributor, spoke on transitioning distributors to the digital world where they can reclaim “the edge back to small business.”

Distributors must have a programmer on the payroll to develop “automatic analytics,” Johnson said. Distributors need a “data dashboard with alerts, triggers.”

“Own your data,” Johnson urged.

With data driven inventory, distributors can compete directly with Fastenal, Grainger and Home Depot. The big chains already dominate search engine advertising. Distributors need to “pick and choose” their online presence, Johnson advised.

But even websites may get outdated, Johnson cautioned.

“It is about the eyeballs,” Johnson said. “What are they looking at? LinkedIn? Videos?”

But they can compete in their niche – such as furniture fasteners.

His own family’s distributorship specialized in O rings. Traditionally the simple small rubber medical device was in boring grey.

“Americans want variety,” Johnson declared in touting success by offering colors such as purple, pink and blue.

To compete, a distributor can move into assembly and repair “bordering on manufacturing,” Johnson said. Small distributors can offer customizing.

Not every idea will work, he acknowledged.

“There are going to be swings and misses.”

Part of his distributorship’s move into the future involved him and his brothers-in-law discussing what each one was good at and not good at.

That must be expanded in companies.

“Team members need to know what they are not good at,” Johnson emphasized.

Fastenal has grown in servicing safety & janitorial businesses. Fastenal installed 100,000 vending machines in customers’ locations.

Small distributors need to “stick to what you do well.” Attack competitors “where they are weakest. Use a digital approach to carve out your market niche.”

Distributors must go digital: “Adapt or be acquired,” Johnson offered alternatives.

Johnson advised distributors to “become self aware. Take stock of current people and processes.” Once personnel understand what they are good at, then “stay in our lanes.”

“Set big goals, but start small” to build toward the big goals, Johnson said. Set up a team to start the process. “Budget time, not money for it.”

“Start simple for innovations wins,” Johnson suggested. Web: ShelfAwareVMI.com

Kelly: COVID-19 Effects To Continue “Well Into Next Year”

The effects of Covid-19 will continue “well into next year,” Larry Kelly of Buckeye Fasteners expects.

As a panelist in a 2020 International Fastener Expo virtual session on fastener manufacturing, Kelly said Buckeye’s 1905 plant is not easy to reconfigure for a pandemic. It is hard to move heavy fastener manufacturing equipment. But Buckeye has created more cellular environment for operators. Operators often have two or more machines, giving them spacing and less operator interaction.

The pandemic has made IT personnel the most valuable, Kelly noted.

Most manufacturing can not be working from home, Kelly said.

Matt Boyd of Parker Fasteners said Parker was fortunate to be moving from a 30,000 sq ft building to 68,000 sq ft, allowing some spacing of equipment as part of following CDC guidelines, Boyd said. Parker also spread out shifts. And Parker added a cafe in the facilities so “no one has to leave to get food.”

No vendors come to the Parker facility, he said.

The pandemic has given the manufacturer “more time to look internally,” Boyd said. “Where can we do better in business?”

Also through zoom calls he found they actually “got closer to the customer.”

What Parker would have spent on exhibiting at the IFE in Las Vegas could be spent in other ways, Boyd said. In direct contact, Boyd spent more individual time with customers rather than being interrupted on a trade show floor.

Parker sales are up “just slightly” for 2020, Boyd said.

Charlie Kerr of Kerr Lakeside acknowledged he is “not a fan of remote work,” but added that “the way work is done is going to be different.”

More than steel prices, has been currency exchange rates with the U.S. dollar getting weaker due to Covid restrictions, Kerr said.

Boyd finds trucking costs increasing more than materials.

Boyd said Parker has been able to hire 18 people this year. Parker favors hiring people without experience and having the company train them.

Kerr Lakeside relies on temporary services for hiring, Kerr said.

Worse than finding employees is having a “plant full of people and no jobs to do,” Kerr said. Web: KerrLakeside.com BuckeyeFasteners.com ParkerFasteners.com

Delayed Wire Düsseldorf Cancelled

Wire Düsseldorf, which had been postponed from March 2020 to December, has now been cancelled for the year.

Messe Düsseldorf attributed the cancellation to Covid-19. There has been a new wave of infections in Europe and elsewhere.

The biennial show will next be held in 2022.

A fastener section was added for the 2020 trade show in Germany.

The U.S.-based International Fastener Machinery & Suppliers Association meets in conjunction with the event.

Prior to the pandemic, Wire Düsseldorf projected 1,300 exhibiting companies from 50+ countries. Messe Düsseldorf reported 38,000 exhibitors in 2018. Web: Wire.de

Beaulieu: Now Is Time To Invest in Your Company

The coronavirus pandemic makes it difficult to plan for business activities in the coming months.

But economist Alan Beaulieu offered some qualified predictions about the U.S. economy over the next year.

But economist Alan Beaulieu offered some qualified predictions about the U.S. economy over the next year.

State governors are unlikely to shut down their economies in the coming months, Beaulieu told Specialty Tools and Fasteners Distributors Association members.

“There’s no data scaring me into thinking the governors want to shut down again,” Beaulieu explained. “We seem to be doing a much better job of managing (the spike in cases) this time.”

The pandemic has caused concern among economists. The federal deficit is at 135.6% of gross domestic product (GDP) – a record high. And there is concern about a possible vaccine because “it’s being rushed to market.”

Congress ‘hit the nail on the head’ with the first sizable stimulus bill, Beaulieu noted. The Coronavirus Aid, Relief, and Economic Security Act (CARES) was a $2.2 trillion economic stimulus bill passed by Congress and signed into law by President Donald Trump on March 27.

“I’m not a fan of government spending, but if you’re going to do it, go big,” Beaulieu said.

Overall, the economy is rebounding, according to Beaulieu. That growth, coupled with historically low interest rates, makes it a great time to invest in your company through acquisitions, expansions and equipment. If you haven’t invested in technology in the past two years, you’re falling behind, he said.

“Borrow,” Beaulieu advised. “Invest in yourself. Make an acquisition.”

Consumers are buying at an incredible pace, he explained. While that’s great for your business now, Beaulieu does think it’s sustainable.

However, jobs are coming back at a very healthy pace. The Federal Reserve Board of Governors is projecting an unemployment rate at 6% by the end of the year. While that may sound high, it’s actually a normal rate of unemployment, according to Beaulieu.

“Things are going up,” he commented. “Life (economically) is good on planet earth, especially in the United States.”

B2B activity is rising but it will take a little time to reach previous economic activity level, according to Beaulieu.

Industrial production is bouncing back. And real estate investors are feeling good right now. Low interest rates and higher vacancy rates means there are good deals out there.

“You’re busy and you’re going to stay busy through 2021.”

Dr. Alan Beaulieu is president and a principal of ITR Economics. Web: ITReconomics.com

Fastener Training Week To Be In-Person in Cleveland

The next Fastener Training Week will be in-person December 7-10, 2020, in Cleveland with masks, temperature checks and physical distancing.

The four-day Fastener Training Institute course leads to the Certified Fastener Specialist designation.

Training includes manufacturing, secondary process and testing plant tours; plus interactive exercises and quizzes.

Topics include thread, material, process, dimensional and quality sites specifications; lot traceability; test reports; print reading and tolerances; thread gaging and dimensional inspection; and torque tension.

Instructors are Salim Brahimi, IFI director of engineering technology; Laurence Claus, NNi Training & Consulting; and John Medcalf, principal engineer, Peak Innovations Engineering.

Early bird registration rates end November 16. There are discounts for members of several fastener associations. Web: FastenerTraining.org

FTI also has a virtual Fastening 101 training class on the Basics of Threaded Fasteners, November 17 & 18, 2020. Claus will be the instructor.

Topics include: Fastener design & material options; head styles & drive features; heat treatment, plating and coatings; market segments; cost differences between fasteners; basic fastener engineering concepts; torque, tightening, tension, stress and bolt strength; thread forming in steel, light metals, aluminum, magnesium and plastic; types of thread pitches; and fastener terminology.

Virtual Meetings Dominate 2021 NFDA & Pac-West Schedules

Schedules for two fastener associations in 2021 show the results of the pandemic: 30 meetings, including 25 ‘virtual’ and only four “in person.” The first in-person event is scheduled for June 2021.

- The National Fastener Distributors Association has 14 virtual events set for 2021. The 15th is a June 22-25, 2021, Executive Sales Planning Sessions in Minneapolis.

- The Pacific-West Fastener Association has virtual roundtable sessions in November and December 2020, plus January, March, April and May.

Pac-West has a “To Be Determined” golf tournament penciled in for May 7, 2021. There are “After Hours” social programs also slated as “TBD” for June, July, August, October and November.

Pac-West has an autumn dinner meeting and vendor showcase set for September 14 and its Holiday party December 2.

Pac-West has a joint conference with the Southwester Fastener Association in San Antonio, October 20-23.

For NFDA information: NFDA-fastener.org For Pac-West information: PacWest.org

NFDA 2021

January 14 Monthly Event: Human Resources – Virtual

February 11 Monthly Event: Operations – Virtual

March 11 Monthly Event: Sales/Marketing – Virtual

March 18 CEO Breakfast Roundtable – Virtual

April 8 Monthly Event: Human Resources – Virtual

May 13 Monthly Event: Operations – Virtual

June 10 Monthly Event: Sales/Marketing – Virtual

June 22-25 Executive Sales Planning Sessions – Minneapolis

July 8 Monthly Event: Human Resources – Virtual

August 12 Monthly Event: Operations – Virtual

September 9 Monthly Event: Sales/Marketing – Virtual

October 14 Monthly Event: Human Resources – Virtual

October 21 CEO Breakfast Roundtable – Virtual

November 11 Monthly Event: Operations – Virtual

December 9 Monthly Event: Sales/Marketing – Virtual

Pac-West 2021

January 29 Lunch Bunch Roundtable – Virtual

March 12 Lunch Bunch Roundtable – Virtual

April 16 Lunch Bunch Roundtable – Virtual

May 7 Golf Tournament – TBD

May 21 Lunch Bunch Roundtable – Virtual

June 17 After Hours: Bay Area – TBD

July 22 After Hours: Denver – TBD

August 19 After Hours: Seattle – TBD

Sept. 14 Dinner Meeting & Showcase – La Mirada, CA

Oct. 7 After Hours: San Diego – TBD

Oct. 20-23 Joint Conference with SFA – San Antonio

November 4 After Hours: Inland Empire – TBD

December 2 Holiday Party – La Mirada, CA

Association Panelists Optimistic for 2021

“The global fastener market was only momentarily frozen and seems to be recovering,” panelist Jamie Lawrence of AVK Industrial Products reflected on 2020’s Covid-19 pandemic.

GDP plummeted 31% in the second quarter, Lawrence noted. But he predicted the economy will largely recover by 2021’s Q2.

The panel was held online after originally being planned for a joint conference of the Southeastern Fastener Association, Southwestern Fastener Association and the Pacific-West Fastener Association in San Antonio in October 2020.

One effect of Covid-19 is an increase in Internet fastener sales, Lawrence said. Grainger is now 67% digital, MSC 61%, Watsco 33% and Systemax 100%.

Covid-19 changed production demand, disrupted supply chains and impacted finances, Lawrence reflected.

The truck market dropped 48% during the early months and automotive output 50%.

Lawrence said fastener distributors “haven’t effectively balanced investments needed to stay relevant and grow their business with cost take-out programs to sustain profitability.”

Some distributors “were initially slow to evolve their business models because they have large fixed costs and organizational structures focused on winning in traditional ways—typically on price and delivery,” Lawrence said.

Lawrence said fastener industry changes due to Covid include holding more safety stock and buying within North America; shifting labor to America; and shifting labor-intensive work from China to Mexico and Central America.

The fastener industry will benefit as the latest chemical manufacturing equipment uses less energy and solvents, produces less waste, is less capital-intensive and is less expensive to operate.

Continuous flow manufacturing is a methodology to optimize minimum inventory.

“This is achieved by manufacturing a product, from start to finish, in one production line,” Lawrence explained.

As the cost of automation declines and people will see that robots can operate safely alongside humans and more kinds of work are being automated, Lawrence said.

A lesson for the industry? Build a safety stock by buying North American manufactured fasteners. And shift labor from China to Mexico.

Lawrence cited a forecast of a 4.1% growth in the global fastener market from 2019 – through 2025.

Bailey: Strong Rebound Coming

Panelist Mike Bailey of Nucor Fastener predicted a “strong rebound coming.”

“Nucor has been pretty bullish across most of their divisions and Nucor Fastener is no exception. The current economic indicators “are green in their 2021 outlook,” Bailey said. “Regardless of who wins in November, the feeling is governmental spending is going to be large and that should translate to spending in the private sector as well.”

There has been a “lack of high profile jobs,” such as large bridges and stadiums in the non-residential construction market, Bailey observed. But non-residential construction is “gaining traction” with infrastructure spending for roads, bridges and power lines. Though there is a lull for fabricators and erectors now, they report “order books are strong for 2021-2022.”

Infrastructure spending “seems to have unilateral support on both sides of the political aisle. Increased spending here would present a very fast path to job creation.”

Bailey noted the U.S. House passed a $1.5 trillion Infrastructure spending bill that stalled in the Senate. The current White House budget for 2021 is $1.3 trillion.

“Expect infrastructure at the federal and state level to get revisited soon after the inauguration,” Bailey predicted.

- The plunge in oil prices to April’s five-year low of $19.33 decimated the oil & gas industry, Bailey pointed out.

Oil is back to $42.45, but the “sweet spot” to support a vast majority of wells pumping needs to be $65 to $70, Bailey said. “That may be late 2021.”

- The heavy truck / automotive markets were “on life support in April,” but the subsequent “uptick appears to be gaining speed and will.”

The biggest speed bump in automotive is “supply chain impediments due to Covid-linked work outages and raw material availability, Bailey said.

Bailey noted the U.S. House passed a $1.5 trillion Infrastructure spending bill that stalled in the Senate. The current White House budget for 2021 is $1.3 trillion.

- MRO orders “stayed fairly strong throughout the pandemic as PPE sales increased dramatically,” Bailey reported. “Many in the industry believe that this fact alone will have a lasting impact on their business as the virus, and its effects, will not go away quickly if at all.”

Bailey predicted 2021 “ puts us back on the path for sustained economic growth. Maybe not a roar, but definitely not a whimper.”

Roberto: Nickel Is Leading Indicator of Stainless Pricing

After Covid spread around the world, the nickel price dropped to $5.07 by March 24, 2020. Nickel came back to $7.14 by September, but fell back to $6.90 by this conference on October 15, Tim Roberto, president of Star Stainless Screw Company reported.

“Nickel is the leading indicator for stainless pricing,” panelist Roberto pointed out.

Nickel is 8% to 14% of makeup of a fastener, but 30% to 40% of price.

For the past five years the price of nickel has depressed the stainless market. The five year average has been $5.45 and the previous five years averaged $8.56.

Nickel jumped to $8.39 a year ago due to speculation that Indonesia would bar exports.

After Covid spread around the world, the nickel price dropped to $5.07 by March 24, 2020. Nickel came back to $7.14 by September, but fell back to $6.90 by this conference on October 15.

Nickel price variation has been lead by demand from China.

Copper pricing is the driver for brass fasteners as it is 60% of the overall cost. Copper is 94+% of silicon bronze.

A year ago copper was $2.62/lb. Speaking in October, Roberto noted copper was at $3.05 that day.

China uses 51% of the world’s copper supply.

Roberto pointed to consumer confidence reaching s 17-year high in September 2020.

Xu: The Fastener Industry Might Not Get Amazon’d But Might Get Tesla’d

The fastener industry might not get Amazon’d but might get Tesla’d, Jun Xu of Brighton-Best International suggested.

An electric motor has one third fewer parts, he pointed out.

Advances in manufacturing to larger forged presses will “only reduce the number of components” and therefore number of fasteners, Xu added.

Fastener manufacturers will switch to more standard fasteners to keep production going, Xu predicted.

- Xu suggested artificial intelligence is more of an assistance to inventory planning than a threat. “Artificial intelligence is only as good as what you feed into it and “2020 has proven to be anything but historically accurate.”

Artificial intelligence can tell you what products are likely to be needed after a hurricane, but “after three hurricanes in a month, maybe not. People might decide to move.”

- BBI believes diversification is vitally important to its future. Fastener companies can diversify through products, material types, measuring standards and by industries.

Watch to see how new products or industries “fit your business model,” he advised.

Do you want to deepen exposure in your current industries or diversify across industries? If you are in more than one industry you have more control of your business, Xu pointed out.

China was affected first by Covid-19 and thus is recovering first, importer Xu said.

Web: TheSEFA.com or SouthwesternFastener.org or Pac-West.org

Economist: ‘Miserabilism’ Is U.S. Economic Enemy

The true enemy to the U.S. economy is “miserabilism,” economist Chris Thornberg told a webinar.

“The economy is learning to deal” with the pandemic, Thornberg finds. But new surges of Covid-19 are now the “wild card” of economic recovery.

Thornberg spoke in a virtual format replacing the live sessions originally planned for a joint conference of the Southeastern Fastener Association, Southwestern Fastener Association and the Pacific-West Fastener Association. The sessions were scheduled for San Antonio in October 2020.

Thornberg called for “more targeted policies,” rather than broad pandemic stimulus. He doesn’t want pandemic panic to lead to the federal government borrowing too much.

With 40 million people stricken by Covid-19, the economy has faced “close to the worst case scenario” that it could, Thornberg said.

Thornberg, from the Southern California-based Beacon Economics LLC, emphasized that the current situation is not an economic recession, but “a natural disaster.” And the good news is that “natural disasters do not tend to have long consequences.”

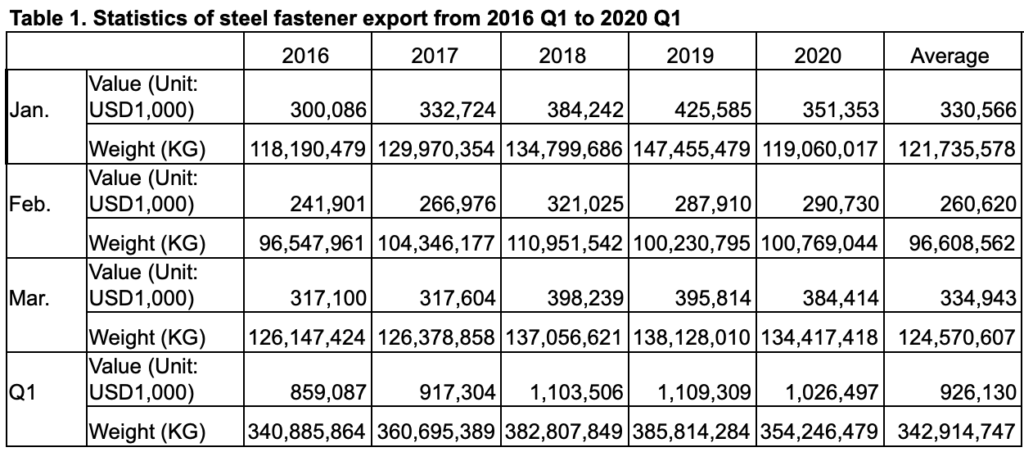

The Taiwan fastener industry has done comparatively well during the pandemic. Taiwan has been only 13.5% down vs. China 30.2% drop.

The Great Recession starting in the first quarter of 2008 and lasting to Q3 of 2009, was the result of six years of excesses and massive imbalances, Thornberg said. There was a low savings rate, massive trade deficit and consumer debt, he pointed out.

In contrast the pandemic recession was “driven by consumer fear” rather than structural shifts. That can lead to a “relatively rapid bounce back.”

The 32.9% plunge for Q2 2020 resulted from “pull backs in consumer spending,” Thornberg said. That is temporary and it is “spending delayed, not cancelled.”

The bottom of the pandemic recession was in April 2020.

There are problems slowing an economic recovery, Thornberg said. “Disneyland can’t operate,” he said in reference to consumers spending again.

There needs to be control of the virus – through immunity or a vaccine, Thornberg acknowledged.

And there needs to be a political atmosphere where there can be “honest conversations,” he added.

When the virus is contained, many consumers have savings to spend – so much so that it could cause inflation, Thornberg observed. Accumulated bank deposits “will be spent when the virus is contained.”

“People are not going to change their behavior,” he explained.

There are winners and losers. The Internet is a winner and aircraft orders are lost with air traffic at only 40% of pre-pandemic traffic. Travel and hotels are down, but health care is up – especially with postponed care.

People have suffered in losing their jobs and may have to change fields. “There are job openings,” Thornberg pointed out.

Many small businesses have been forced to close, but small companies are always coming and going, he pointed out.

There could be a third surge of the pandemic, Thornberg cautioned. “This thing is hard to get rid of.”

The pandemic changed the economy, Thornberg noted. Pre-pandemic, some economists were predicting an end of the 2020 recession.

Web: TheSEFA.com or SouthwesternFastener.org or Pac-West.org

Optimas Solutions Opens PPE & MRO Facility in St. Louis

Optimas Solutions opened a 30,400 sq ft facility in St. Louis to distribute a new line of manufacturing products focusing on personal protective equipment (PPE) and MRO.

Scott McDaniel

The product lines and dedicated distribution facility in the middle of the U.S. will address urgent customer demands for indirect and consumable items, especially safety products due to COVID-19, the company stated.

“The goal of this strategy is to be laser focused on those products that are in urgent demand by our customers,” stated newly promoted CEO Marc Strandquist. “We’ve listened to and learned that our customers don’t necessarily need full-line distribution right now, but instead need Optimas to meet their needs for common items in a dedicated, efficient manner. With this new line and new distribution facility, our goal is to simplify product selection and quickly deliver what our customers need most at the best value possible.”

Safety products will focus on personal protection and sanitation products for the workplace, including face masks, sanitizers, cleaning products, hearing protection, hand protection and body coverings.

MRO offerings will focus on materials, equipment and production supplies, including adhesive, abrasive, tape and packaging materials, along with janitorial supplies and cutting, repair and hand tools.

Strandquist appointed 23-year fastener industry veteran Scott McDaniel to oversee the operation. Strandquist worked with McDaniel at Würth Industry North America, where McDaniel served as national accounts manager. During his career, McDaniel also served as CEO of Würth Addams.

“Our customers of our engineered fasteners can now take advantage of our ability to also supply them with a focused set of MRO and safety products, while reducing the number of suppliers and related administrative costs,” McDaniel stated.

Optimas was formed in 2015 when New York private equity firm American Industrial Partners acquired Anixter’s OEM Supply Fasteners division at auction for $380 million cash.

Glenview, IL-based Optimas provides fasteners and c-class components and services to OEMs and Tier 1 suppliers in the automotive, agricultural, and medical equipment markets. The company has 1,600 employees in 16 countries, and manufactures in Illinois and the UK. Web: Optimas.com

Covid-19 Cuts Global Nickel Production

2020 global nickel production is expected to decline by 7.4% to 2,195 thousand tons (kt).

Temporary suspensions of mines caused by the COVID-19 pandemic, along with the advancement of Indonesia’s export ban, are expected to be major contributors to decline, according to GlobalData, a data and analytics company.

Indonesia’s 2020 mine production is expected to fall 15%.

Vinneth Bajaj, GlobalData senior mining analyst, said Indonesian nickel mining companies have had trouble selling output to domestic smelters at low prices alongside inadequate capacity.

“Therefore, domestic miners have been either halting or curbing their output in the first three quarters of the year and this is expected to continue over the rest of 2020.”

Mine production in the Philippines is forecasted to fall by 9.3%, due to dual challenges of COVID-19 and weather disruptions. In April 2020, Nickel Asia Corp. and Global Ferronickel Holdings Inc. suspended operations in the Surigao del Norte province, where most of the country’s mines are located, due to the COVID-19. Operations resumed in May with safety protocols.

“In contrast, despite the challenges caused by the COVID-19 pandemic, production in New Caledonia and Brazil is expected to collectively increase by 6.9% in 2020,” Bajaj said.

For 2021-2024 global nickel mine production is expected to recover at a growth rate of 4.2%. Indonesia, Australia, the Philippines and Canada will be the key contributors.

Matten: Rare Synchronicity & Chemistry Built Fastener Fair

“There are two powerful things in business that really cannot be engineered: Synchronicity and chemistry,” Phil Matten reflected on his fastener career as he retires as editor of Fastener + Fixing Magazine.

Credit: FastenerBlog.net

“Jerry, Jamie and myself came together at the right time, really by accident, to form a potently complimentary bond of skills. Jerry was a serial entrepreneur, imbued with a sometimes breath-taking risk orientation. Jamie was an outstanding salesman then and has become a highly competent director. I contributed a more strategic marketing approach, a network of European fastener contacts, and, perhaps above all, the recognition that Fastener Fairs and Fastener + Fixing were nascent brands with huge potential.”

Matten was describing 2002 when he joined Jerry Ramsdale, publisher of Fastener + Fixing magazine, organizer and founder of the fledgling UK-based Fastener Fair.

“It was entirely an accident that I became editor of the magazine,” Matten recalls. “Jerry’s editor, sales and production managers, left the business in an abortive attempt to set up a rival publication and show. I’d known Jerry for several years, and he called me – to this day I still don’t really know why. Following day, we had a beer and I started doing some freelance writing for the magazine,” Matten recalled. “A few issues later, I found I was the editor!”

Jamie Mitchell – now publications director at RELX Mack Brooks – came into the business at the same time.

“It was an extraordinary time for a small business that punched way, way above its weight,” Matten noted.

Matten started in fasteners in 1976 as a UK automotive aftermarket distribution group regional salesman. He soon became the youngest branch manager and four years later moved to the head office to establish a marketing and promotional support service for the 50 branches. He later took on purchasing and marketing management.

“I realize now that many talented managers invested in my development, through example, formal training and other opportunities to hone a skills base in sales, marketing, purchasing and general management,” Matten reflected. “This is where I also developed an acute and enduring recognition of the strengths of branding, and in particular the core requirement to always deliver genuine value.”

Those skills led to joining a team developing a brand program of consumables and parts for the earthmoving aftermarket.

Entry proper to the fastener industry was in 1990 when Heinz Storch determined to bring in ‘big company skills’ to the board of Fastbolt Distributors (UK) Limited. Matten was appointed as Fastbolt’s sales and marketing director.

Fastbolt, an importer/wholesaler supplying distributors, was then supplying the UK and Ireland, but growing an export business. Subsequently, owner Heinz Storch, returned to his country of birth, and established Fastbolt Schraubengrosshandels GmbH in Gronau, Germany, now the company’s headquarters.

Storch died unexpectedly in 2008.

“A day I will never forget. Our relationship often crackled with tension but there was always underlying mutual respect and I learnt massively from Heinz and the Fastbolt experience, not least about the UK, European and global fastener supply chains.”

Storch’s legacy continues as Fastbolt has grown, under managing director Ekkehard Beermann, to be a European master distributor with logistics centers in Germany, UK and Portugal and quality assurance center in Shanghai. Web: fastbolt.com

Matten was headhunted in 1996 to become managing director and found a new UK subsidiary for German fastener manufacturer, Altenloh Brinck & Co.

“It was a new experience for me, founding a small business from scratch, learning a new set of skills, supported by a truly remarkable company,” Matten told GlobalFastenerNews.com. “If ever proof is needed of the importance of genuine brand value it has to be SPAX.”

A few years later Matten joined previous colleagues in the Internet venture FastenerExchange. Matten termed it “ill-fated” but described FastenerExchange as “a thrilling, if short-lived ride, with a great team of people. It was simply too far ahead of its time. I smile today to see developments in global online trading that echo the core concept of FastenerExchange.”

In 2010, Fastener Fair was acquired by Mack Brooks Exhibitions, which Matten termed “a rare but genuine win-win deal.” Fastener Fair Stuttgart had established itself in the European fastener industry, and “grown beyond all expectations,” Matten said.

“It was time for a new owner with the resources and skills to take it forward to become one of the great global fastener events. Look at it now!”

Fastener + Fixing Magazine had also grown in page count, issues, readership and advertisers, providing “real brand value to readers and advertisers in the form of high quality editorial content” and by Matten as “being there.” “I travelled the length and breadth of the European fastener industry, initially interviewing people I knew, and gradually gaining access to most of the major manufacturers, distributors or technology providers.” Beyond Europe, Matten visited fastener companies in Asia, North America, Russia and South America.

“I stopped counting how many fastener companies I had visited some years ago but it is many hundreds!”

GlobalFastenerNews.com was one of F+F’s first international news partners, followed by Fastener World in Taiwan.

What’s changed over Matten’s decades in the industry?

“The big have got bigger, through acquisition and merger,” Matten responded. “Some key European and North American companies are now Asian owned. To survive and hopefully prosper the smaller fastener companies have specialized, by geography, market sector or product range.

“Those trends will continue, maybe accelerate as a result of coronavirus, Matten predicted.”

“One thing is for sure, the pandemic has deeply impacted aerospace and automotive sectors, and the repercussions continue to reverberate through the fastener supply chain,” Matten said. “The short term imperative is to try to go back to how it was before. Maybe that will happen. However, we really are at a tipping point for the global environment so perhaps the time has come to recognize there is no going back.

“When I moved from automotive to fasteners it was like stepping backwards in terms of market structures,” Matten recalled. “There is still a high level of family ownership in the fastener sector, wherever one looks – Asia, Europe or North America. Some of those family businesses have grown to be global leaders, others trade on at a smaller, perhaps more marginal scale.

“I’ve often called this a Cinderella industry, and it is. Far too often, what is supplied is taken for granted, undervalued even denigrated,” Matten said. “It’s only a screw” – sound familiar? That is one thing that has not changed enough.”

Matten noted an increase in customizing fastening technologies to application, plus services such as VMI.

There have advances in fastening technologies, effectiveness and efficiency. Matten cited how woodscrews now offer greater differentiation between performance features and real investment in brand recognition.

Fasteners don’t account for more than 1% of any finished product, combined with low unit value, “means a constant pressure towards commoditization. That will never change but as an industry it has to be resisted, and constantly reinforced that fasteners are genuine, even if often miniature engineering I wince, when I hear an end-user buyer say “send me something that will do” with complete disregard for safety or standards. What is infinitely worse is when a fastener supply obliges.”

Matten has been general secretary for the British & Irish Association of Fastener Distributors for 20 years and director for six years.

“The coronavirus has demonstrated more than ever the importance in BIAFD ensuring its members are better informed,” Matten said.

Matten expects to continue to work with the European Fastener Distributors Association, of which BIAFD is a founding member.

For three years Matten has worked with the Confederation of British Metalforming to strengthen its fastener manufacturing sector. Matten recently turned that role over to Derek Barnes, who has experience in cold forming manufacture of fasteners.

Next?

“If my grandchildren allow it, I’ll try to get in some freelance writing and maybe even some golf!” Email: phil@fastenerintelligence.com

White Advises Pac-West: Train Employees on Cybersecurity

The increasing number of employees working from home due to the pandemic has heightened a problem for Pacific-West Fastener Association members, a cybersecurity consultant said in a webinar.

“As employees work offsite, we are more vulnerable to cyber attacks,” Jeff White of WTC IT Services told Pac-West.

Indeed, Pac-West members have been attacked, White said without naming specific companies.

The average cost to the business owner is $84,116, White said. The City of Lafayette paid $45,000, while the University of California / San Francisco paid $1.14 million.

Ransomware is malware used to obtain and publish the victim’s data or perpetually block access to it unless a ransom is paid. Variations of ransomware have multiplied 50 times since 2017, White said.

Businesses are being attacked at a pace of once every 11 seconds.

So what’s a business owner to do?

“Train, review and test employees,” White urged.

The days of “one location, one owner” are past, White observed. “I’m small, I can’t worry about that” rarely applies.

Conducting a Pac-West webinar on “What mask does your technology wear?” White cautioned Pac-West members that employees working from home increase security problems with multiple devices.

“Protect everything,” White declared.

- The most important step is to train employees on cybersecurity. Identify spam and malware. Employees need to understand “password hygiene” and “power down, power off electronics when not in use.”

It isn’t just their cell phone or laptop, White emphasized. Today those are connected to smart refrigerators, thermostats and baby monitors. Homes become “branches of your business,” White observed.

- At the office, employees are near a shredder. At home the same papers go into the recycling bin, White pointed out.

- Employees’ phones or laptops might be used on a Starbuck’s patio or at a child’s dance class.

- Conduct timely audits on electronics being used for your business, White advised. Control those devices and connections.

- Invest in appropriate firewalls.

- Monitor traffic and control or block access.